Marion County Appraisal District Indiana

DLGF: Marion

Budget The budget order is a critical document in calculating tax bills. The order contains the state's certification of the approved budget, the certified net assessed value, the tax rate, and the levy for each fund of each taxing unit in a county.

https://www.in.gov/dlgf/county-specific-information/marion/

indy.gov: Marion County Treasurer’s Office

How we serve you Collects and invests property taxes. The Marion County Treasurer's Office bills, collects, invests, and distributes property taxes and provides financial analysis related to these functions. Property tax due dates are May 11, 2026 and November 10, 2026.

https://www.indy.gov/agency/marion-county-treasurers-office

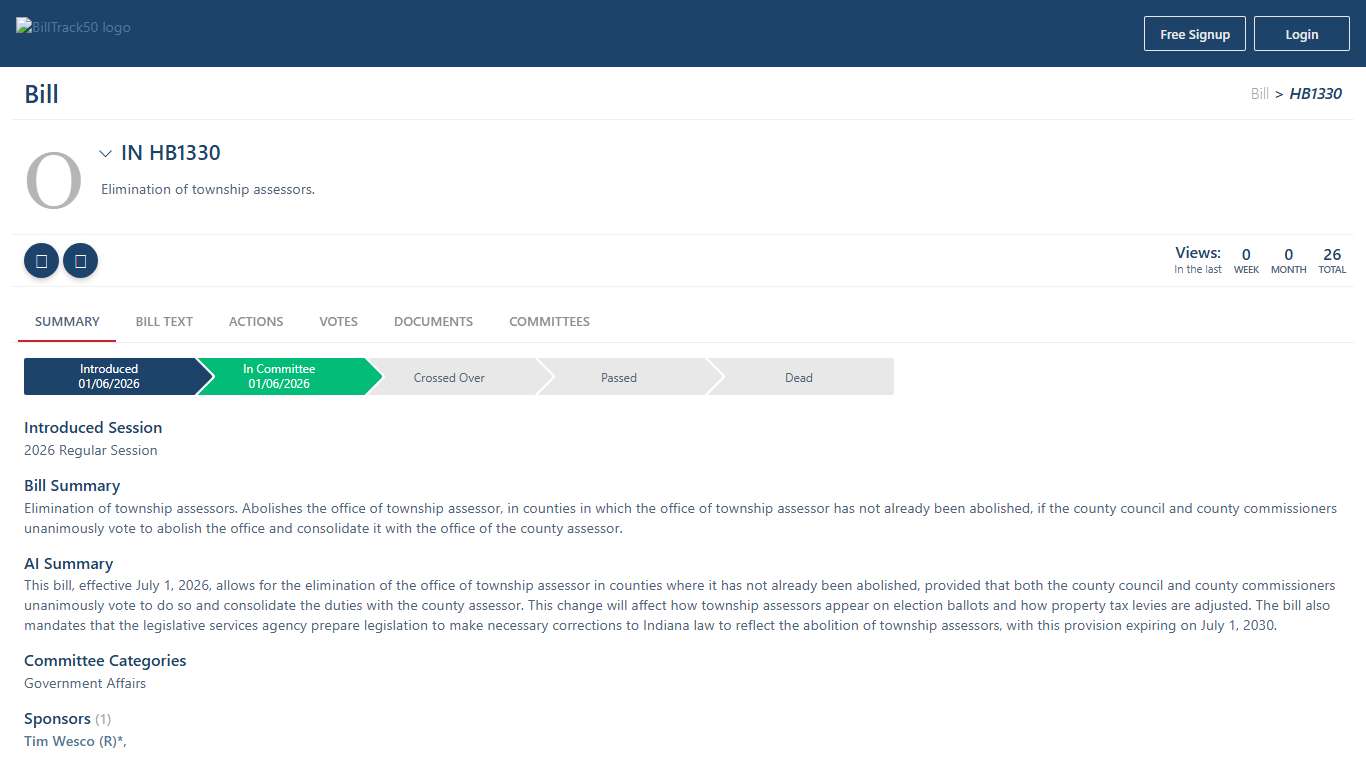

IN HB1330 BillTrack50

summary 01/06/2026 01/06/2026 Introduced Session Bill Summary AI Summary Committee Categories Sponsors (1) Last Action bill text IC 3-10-1-19, AS AMENDED BY P.L.227-2023, SECTION 58, IS AMENDED TO READ AS FOLLOWS [EFFECTIVE JULY 1, 2026]: Sec. 19. (a) The ballot for a primary election shall be printed in substantially the form described in this section for all the offices for which candidates have qualified under IC 3-8.

https://www.billtrack50.com/billdetail/1921403

2026 Budget Presentation

The Marion County Assessor's Office locates, identifies, and appraises all taxable ... and department/duty consolidation is emanate in 2026. • Explore how AI can ...

https://us-east-1-indy.graphassets.com/ActDBC5rvRWeCZlNNnLrDz/cmfojd6450r0408ljt2lwsriaIndiana assessed value grows 12% as property tax changes take effect • Indiana Capital Chronicle

7:00 News Story Gross assessed values for commercial, industrial and residential properties throughout Indiana collectively rose 12% from 2024 to 2025, according to a statewide comparison chart assembled by the Department of Local Government Finance for property taxes due and payable in 2026.

https://indianacapitalchronicle.com/2025/07/08/indiana-assessed-value-grows-12-as-property-tax-changes-take-effect/

Location Cost Modifiers for the 2026 Annual Adjustment

These modifiers are to be used for the January 1, 2026, assessment date. The Department provides this information for counties to adjust their ...

https://www.in.gov/dlgf/files/2025-memos/251031-Wood-Memo-Location-Cost-Modifiers-for-the-2026-Annual-Adjustment.pdfIndiana Property Taxes Climb as State Increases Base Cost Estimates Publications Insights Faegre Drinker Biddle & Reath LLP

At a Glance - For 2025 assessments, Indiana’s Department of Local Government Finance eliminated a downward adjustment (called a Verified Economic Multiplier) that previously applied to the Indiana cost tables, which, in turn, resulted in substantial increases in base costs. Because these base costs are typically the starting point for calculating a property’s assessed value in Indiana’s mass appraisal system, it affected most properties’ final...

https://www.faegredrinker.com/en/insights/publications/2025/5/indiana-property-taxes-climb-as-state-increases-base-cost-estimates

indy.gov: Property Tax Assessment Board of Appeals

Property Tax Assessment Board of Appeals Makes decisions on assessment appeals The Property Tax Assessment Board of Appeals (PTABOA) is responsible for reviewing property tax assessment appeals submitted by taxpayers who believe their assessments are inaccurate. The board considers both objective data and subjective claims in its evaluations.

https://www.indy.gov/activity/property-tax-assessment-board-of-appeals

Indiana's Property Tax Overhaul: Big Cuts, New Levers Insights KSM (Katz, Sapper & Miller)

Indiana's Property Tax Overhaul: Big Cuts, New Levers Indiana has entered a new era of tax policy. With the passage of Senate Bill 1 on April 15, 2025, and House Bill 1427 on May 6, 2025, state lawmakers have enacted sweeping reforms that will reshape how property is taxed and how local governments can generate revenue.

https://www.ksmcpa.com/insights/indianas-property-tax-overhaul-big-cuts-new-levers/

Marion Central Appraisal District

Agent 00010 - RYAN, LLC 00123 - HEGWOOD GROUP 006825 - BDO USA, LLP 01-46256 - ADVANTAX GROUP LLC 01-60124 - ADVANTAX GROUP 01-60174 - ADVANTAX GROUP LLC 01-75006 - ADVANCED PROPERTY TAX COMPLIANCE 01-75495 - ADKINS, S J III 01-75653 - AFFILIATED TAX CONSULTANTS 01-76051 - AD VALOREM SERVICES COMPANY 01-77040 - AMBROSE & ASSOCIATES LLC 01-78205 - ARTHUR P VELTAMEN & ASSO 01-78466 - JAMERICAN AD VALOREM TAX...

https://www.marioncad.org/

Legislative Research: IN HB1193 2026 Regular Session LegiScan

Legislative Research: IN HB1193 | 2026 | Regular Session Other Sessions References Online Legislative Citation APA IN HB1193 | 2026 | Regular Session. (2026, January 27). LegiScan. Retrieved January 28, 2026, from https://legiscan.com/IN/bill/HB1193/2026 MLA "IN HB1193 | 2026 | Regular Session." LegiScan.

https://legiscan.com/IN/research/HB1193/2026

indy.gov: Property Tax Assessment Board of Appeals

Property Tax Assessment Board of Appeals Makes decisions on assessment appeals The Property Tax Assessment Board of Appeals (PTABOA) is responsible for reviewing property tax assessment appeals submitted by taxpayers who believe their assessments are inaccurate. The board considers both objective data and subjective claims in its evaluations.

https://www.indy.gov/activity/property-tax-assessment-board-of-appeals

IN HB1210 BillTrack50

summary 01/05/2026 01/27/2026 Introduced Session Bill Summary AI Summary Committee Categories Sponsors (4) Last Action bill text IC 4-23-7.3-5.5 IS ADDED TO THE INDIANA CODE AS A NEW SECTION TO READ AS FOLLOWS [EFFECTIVE JULY 1, 2026]: Sec. 5.5. As used in this chapter, "governmental boundary units" includes: (1) the geographic boundaries of a political subdivision; (2) the geographic boundaries of a taxing district (as defined by IC 6-1.1-1-2...

https://www.billtrack50.com/billdetail/1920751

Indiana Property Taxes Climb as State Increases Base Cost Estimates Publications Insights Faegre Drinker Biddle & Reath LLP

At a Glance - For 2025 assessments, Indiana’s Department of Local Government Finance eliminated a downward adjustment (called a Verified Economic Multiplier) that previously applied to the Indiana cost tables, which, in turn, resulted in substantial increases in base costs. Because these base costs are typically the starting point for calculating a property’s assessed value in Indiana’s mass appraisal system, it affected most properties’ final...

https://www.faegredrinker.com/en/insights/publications/2025/5/indiana-property-taxes-climb-as-state-increases-base-cost-estimates

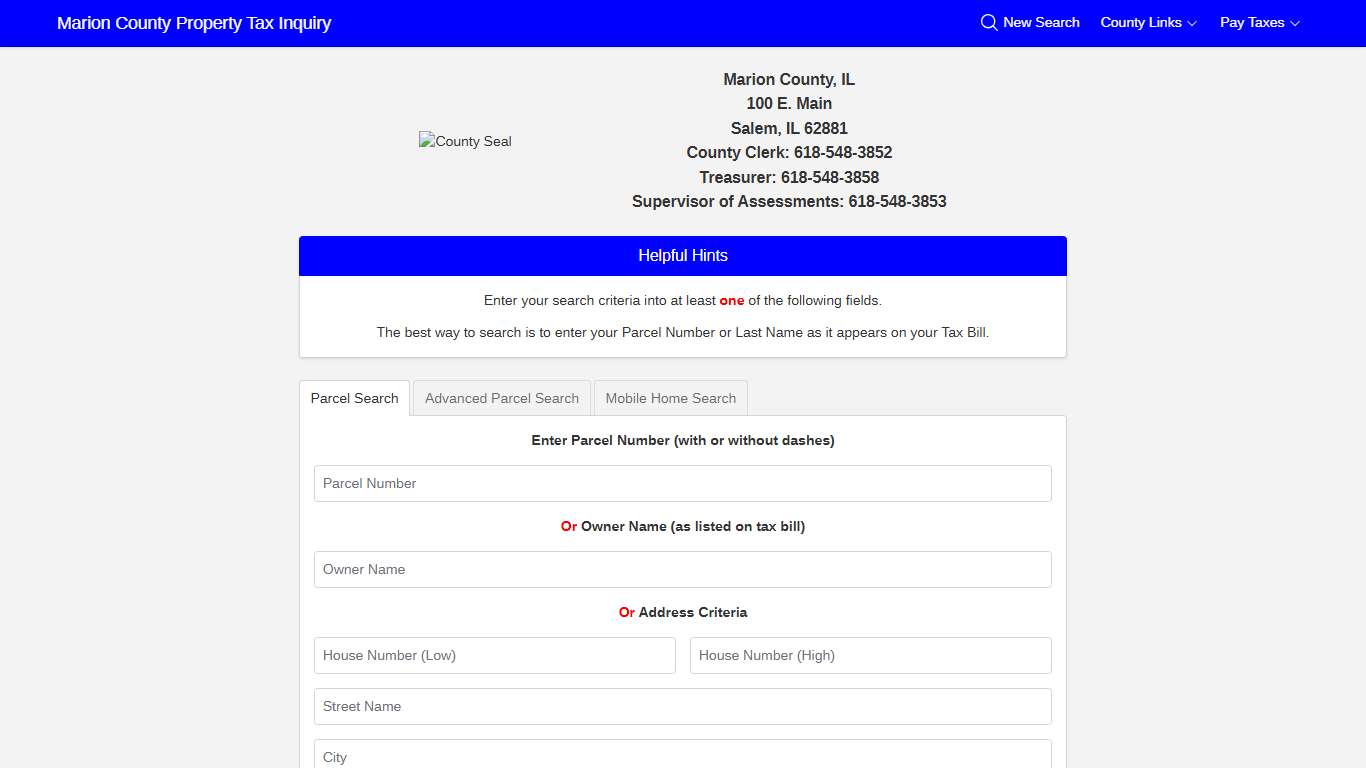

Marion County Property Tax Inquiry

Marion County, IL 100 E. Main Salem, IL 62881 County Clerk: 618-548-3852 Treasurer: 618-548-3858 Supervisor of Assessments: 618-548-3853 Enter your search criteria into at least one of the following fields. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

https://marionil.devnetwedge.com/

Marion Central Appraisal District

2026 Board of Directors Agendas and Minutes...

https://www.marioncad.org/home/DataRecords

Marion County assessor: taxes rise from prior sales, appeals due June 15 Citizen Portal

Marion County assessor: taxes rise from prior sales, appeals due June 15 Summary Marion County Assessor Joseph O'Connor told a county recorder broadcast that property assessments are based on prior 12 months of sales tied to a Jan. 1 valuation date, that taxes are billed in arrears, and that homeowners can appeal assessments by the June 15 deadline.

https://citizenportal.ai/articles/6237154/Indianapolis-City/Marion-County/Indiana/Marion-County-assessor-taxes-rise-from-prior-sales-appeals-due-June-15

Marion County Property Assessment Appeals Process

Appeal a Property Tax Assessment in Marion County You have the right to appeal the assessed value of your property if you feel it is unfair or incorrect. You can file two types of appeals: an objective appeal or a subjective appeal.

https://wilmothgroup.com/blog/marion-county-property-assessment-appeals-process/